Financial institutions, with their vast monetary and data assets, are prime targets for cybercriminals. Cyber-attacks can cause reputational damage, funding issues, and even insolvency. The International Monetary Fund’s Global Financial Stability Report reveals that a quarter of reported incidents in the past 20 years resulted in $12 billion in direct losses for financial firms.1

With the increasing complexity and scale of cyber threats, as indicated by Gartner’s projection, enterprise spending on combating malinformation will exceed $30 billion by 2028. This makes AI’s role in financial institutions not just critical, but also indispensable. The integration of AI with other emerging technologies, such as blockchain and deep learning, will be key to staying ahead of cybercriminals.

Acknowledging this, we can surely ascertain that security is one of the biggest concerns for these financial institutions. However, the need is to identify secure and effective ways to combat modern-day cyber threats. Looking at the value AI has added across different industries and verticals, it’s important to evaluate if AI has the right ingredients needed to address these issues.

By 2028, enterprise spend on battling malinformation will surpass $30 billion, cannibalizing 10% of marketing and cybersecurity budgets to combat a multifront threat.

Gartner®

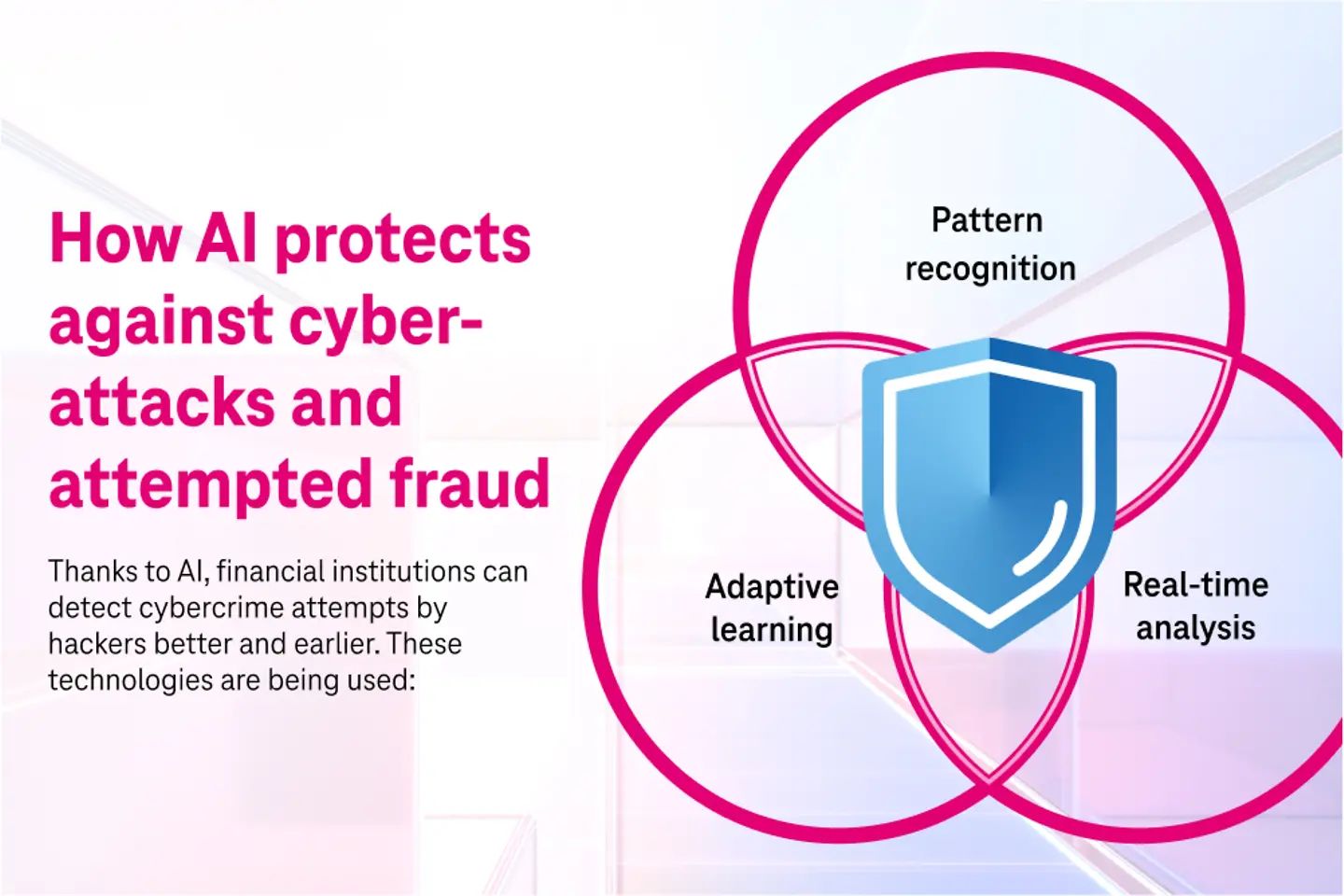

AI is a leading solution to modern-day security concerns due to its ability to analyze vast amounts of data with unprecedented speed and precision. Using ML algorithms and advanced analytics, AI can detect anomalies and patterns that human analysts might miss.

Real-time analysis: Real-time analysis enables financial institutions to get business intelligence insights and detect fraud or money laundering, which can cause major financial and reputational losses. Real-time analytics can detect anomalies before they escalate. With ML algorithms in place, financial institutions can catch risks in real time, while boosting efficiency and delivering a personalized banking experience.

Pattern recognition: Pattern recognition in ML has evolved from requiring manual efforts to an automated and highly efficient process. Patterns denote sequences and consistencies in data, often revealing trends, relationships, and structures. This process involves acquiring and preprocessing data, transforming it into an easy format for ML algorithms to learn, and then using these insights to make informed decisions during fraud detection and market analysis. Pattern recognition can help both fintechs and established financial organizations to enhance their operational efficiency while catering personalized and secured products to their clients.

Adaptive learning: Adaptive learning or adaptive AI is crucial for detecting and preventing fraud. It also helps provide personalized banking services. It can analyze enormous amounts of data and identify patterns and anomalies in real-time, enabling organizations to immediately act against fraudulent activities, while delivering seamless experiences to end users. Financial institutions can analyze customer data to assess risk factors in real time and make data-backed predictions. They can leverage the technology for investment risk assessment, credit scoring, and portfolio management.

By 2026, at least one commercially successful LLM will need to be retrained as a result of intentional pollution with malinformation.

Gartner®

AI continues to evolve, with trends pointing towards advanced behavioral analytics and deep learning models that will enable financial institutions to identify complex fraud patterns. As Gartner’s research suggests, the integration of AI with blockchain will also be pivotal in enhancing data privacy during fraud detection. The combination of these technologies will enable more robust defense mechanisms against the growing threat of malinformation, which Gartner defines as algorithmically groomed and targeted disinformation designed to undermine decision-making processes.

Deep learning models, such as Enhanced Neural Networks (ENN), including Recurrent Neural Networks (RNNs) and Convolutional Neural Networks (CNNs), will play a key role in identifying anomalies and complex patterns. Going forward, hybrid options, such as merging deep learning with reinforcement learning, will further enhance these capabilities.

Integration of AI with blockchain: Integrating AI with blockchain will enhance data privacy, ensuring the protection of sensitive information throughout the fraud detection process. These technologies will use AI algorithms to analyze blockchain data, smart contracts for automated enforcement, and AI models using blockchain-distributed ledgers for data sharing and processing across multiple nodes.

Explainable AI (XAI) for regulatory compliance: Explainable AI (XAI) will become increasingly important in compliance, providing clear and logical explanations for AI-driven decisions. This transparency will help organizations meet regulatory requirements and build trust among users. AI paradigms will evolve for more definable results in line with evolving regulations, such as the GDPR and the upcoming EU AI Act.

By 2026, deepfake fraud will rise from a newsworthy novelty to a commonplace occurrence affecting individuals, enterprises and governments.

Gartner®

At T-Systems, we leverage AI to meet industry-specific challenges, enhance security, improve customer experience, and ensure scalability, flexibility, and cost efficiency. Our AI solutions are designed to minimize false alerts and precisely distinguish between suspicious and legitimate activities, ensuring smoother transactions and greater customer satisfaction.

We follow enhanced security measures to safeguard your sensitive data. Our technocrats leave no stone unturned to protect you from modern threats, delivering secure and seamless interactions. By automating major processes, our AI solutions reduce the need for manual intervention, lowering operational costs and optimizing resource allocation.

In the ever-evolving financial sector, where compliance and security are paramount, T-Systems stands out as the partner of choice. We offer comprehensive solutions that address the unique challenges faced by financial institutions, such as regulatory complexities and cybersecurity threats. By leveraging sovereign cloud, advanced AI technologies, and deep expertise in legal frameworks, T-Systems ensures that your organization remains compliant, secure, and future-ready. With us, you can navigate the regulatory landscape with confidence, protect your valuable assets, and focus on what matters most – driving innovation and growth in a secure environment. Choose T-Systems to empower your financial operations with cutting-edge technology and unparalleled expertise.

1 International Monetary Fund’s Global Financial Stability Report, April 2024, Chapter 3